IMPACT

La prima piattaforma di formazione gratuita e accreditata al mondo per investimenti sostenibili e responsabili

L’Accademia di Candriam intende promuovere la consapevolezza, l’istruzione e la conoscenza degli intermediari finanziari in materia d’investimento sostenibile e responsabile attraverso una piattaforma on-line innovativa con contenuti e materiali ispiratori e di pratica utilità.

L’Accademia di Candriam è gratuita e aperta a tutti (anche se è stata concepita tenendo a mente le esigenze degli intermediari).

Humans cause the Global Temperature rise

Directly contradicting much of the Trump administration’s position on climate change, as reported by the New York Times, 13 federal agencies unveiled an exhaustive scientific report on Friday that says humans are the dominant cause of the global temperature rise that has created the warmest period in the history of civilisation.

The report says the Earth has set temperature highs for three years running, and six of the last 17 years are the warmest years on record for the globe. Weather catastrophes from floods to hurricanes to heat waves have cost the United States $1.1 trillion since 1980, and the report warns that such phenomena may become common.

“The frequency and intensity of extreme high temperature events are virtually certain to increase in the future as global temperature increases,” the report notes. “Extreme precipitation events will very likely continue to increase in frequency and intensity throughout most of the world.”

In the United States, the report finds that every part of the country has been touched by warming, from droughts in the Southeast to flooding in the Midwest to a worrying rise in air and ground temperatures in Alaska, and conditions will continue to worsen.

This assessment concludes, based on extensive evidence, that it is extremely likely that human activities, especially emissions of greenhouse gases, are the dominant cause of the observed warming since the mid-20th century,” the report states. “For the warming over the last century, there is no convincing alternative explanation supported by the extent of the observational evidence.”

The findings, other researchers said, create an unusual situation in which the government’s policies are in direct opposition to the science it is producing.

“This profoundly affects our ability to be leaders in developing new technologies and understanding how to build successful communities and businesses in the 21st century,” said Christopher Field, director of the Stanford Woods Institute for the Environment. “Choosing to be dumb about our relationship with the natural world is choosing to be behind the eight ball.”

A Call to action for every Companyand Business Leader

To assure its future and the sustainability of its growth every company has to set its proper strategic targets to help the World face this challenge. As Neil Carson, chief executive of FTSE 100 chemicals and process technologies firm Johnson Matthey from 2004-14, presciently said of corporate sustainability:

“It’s like the quality revolution that we had in the 1980s. What happened was that companies either ‘got’ quality, or they died. And one day this is going to be the same for sustainability. But there’s an interim period where that’s only true for some companies, not all companies.

So what exactly are the corporate sustainability leadership competencies that are required in organisations that don’t want to die?

An influential taskforce-based study, involving corporate leaders’ own views on the issue, was published in 2010 by Business in the Community, a business-led charity promoting responsible business and corporate responsibility.

Entitled Leadership Skills for a Sustainable Economy, it defined a number of corporate sustainability leadership attributes, including the ability to consistently work towards a longer term vision of how the organisation might contribute to a sustainable economy, together with an ability to inspire people—both inside and outside the organisation—to take action on corporate sustainability

When it comes to corporate sustainability leadership competencies, David Grayson, Professor of Corporate Responsibility and Director of the Doughty Centre for Corporate Responsibility, suggests these four qualities are amongst the critical building blocks:

- The ability to contextualise; to understand sustainable development trends, and how and where your own organisation fits into the wider system – strategic systems thinking;

- The surfacing of a personal purpose, together with authentic values;

- A capacity to inspire and empower in a corporate sustainability context; and increasingly,

- The ability to conceive, create, continuously improve and—where appropriate—exit collaborations with other businesses and interested parties.

Easy? Simple? Straightforward? Of course not. But then, corporate sustainability itself isn’t any of these things, either.

Are the leaders of our companies and businesses ready to embark in a journey of change? Read more on The Happy CFO how Finance leaders can help.

The need for an integrated reporting

Globalization and interconnectivity mean the world’s finances, people and knowledge are inextricably linked, as evidenced by the global financial crisis. In the wake of the crisis, the desire to promote financial stability and sustainable development by better linking investment decisions, corporate behaviour and reporting has become a global need.

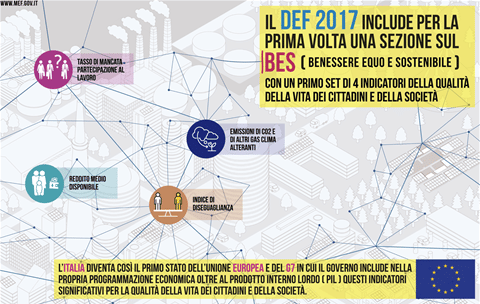

Italy first country to target non economic measures

Italy is the first among G7 and EU countries to fix its 2020 targets adding non-economic measures combined with GDP growth, country deficit and Debt to GDP ratio. Specific policies are then included in the Economic Financial Document (DEF) approved on April 12th 2017 to improve population well being.

Thomas Jefferson’s proposal to politicians that “the care of human life and happiness … is the only legitimate object of good government.” Is taking some concrete steps.

Italy aligns also with United Nations aspiration that the pursuit of happiness is a fundamental human goal, recognizing the relevance of happiness and well-being as universal goals and aspirations in the lives of human beings around the world and the importance of their recognition in public policy objectives, recognizing also the need for a more inclusive, equitable and balanced approach to economic growth that promotes sustainable development, poverty eradication, happiness and the well-being of all peoples.

Italy takes action despite uncertainty in defining and measuring Happiness

While the debate is still on how best define Happiness – by Wikipedia is a mental or emotional state of well being defined by positive or pleasant emotions ranging from contentment to intense joy but various research groups, including positive psychology and happiness economics are employing the scientific method to research questions about what “happiness” is, and how it might be attained and measured. Academia is still reflecting among the at least 3 types of definitions: economic happiness, well-being and eudemonic – after 7 years of preparation, Italian government selected 4 out of the many measures proposed by different international institutions to fix its aim.

While various international organizations (UN, OECD, EU commissions) are debating about the way to measure it, for example OECD has even issued in 2013 Guidelines that “mark an important turning point in our knowledge of how subjective wellbeing (happiness) can, and should, be measured” after its 2009 decision that individual well being should be multidimensional, taking into account individual assessment of his/her status as well as defining indicators about environmental and social effects. In 2011, the OECD developed its first ever framework for measuring well-being, focusing on 11 key aspects of life: The OECD “How’s Life?” report provides evidence on well-being in 34 OECD countries and some emerging economies. The third edition on of “How’s Life?” was released in October 2015. In it 11 dimensions to define well-being were set: Housing Income and wealth, Jobs and earnings, Social connections, Education and skills, Environmental quality, Civic engagement and governance, Health status, Subjective well-being, Personal security, Work-life balance.

Then many institutions are trying to measure it while Italy decided to target it, taking the lead and publicly stating its commitment

Italy aims to a Fair and Sustainable Well Being

Fair and Sustainable Well Being (BES) Commission, born in 2010 with the intent to measure human well being (health, education) and social wellness, has finally identified the four measures that will base the non economic policies in Italy in the next 5 years. The first one is Average available per capita income that was flat at about 21.7k euros until 2016 will grow by 13% until 2020 to 23.9K euro where GDP is expected to grow half that percentage. Policies that will reduce taxation, ease access of people to work, reduce poverty should aim to reach that result. The second target is the index that measure Perceived inequality of income between top 20% of population with the bottom 20%. It will improve from 6.4 to 5.8 allowing a fairer distribution of wealth and income within the country. After the crisis the delta between these two groups has increased, then readjustment policies should be set. The third target measure Active population willing or available to be involved in the job market. Being unemployed is seen as one major cause of unhappiness then social support and specific policies will increase participation to work by about 10% allowing more people to work. Finally, CO2 emissions will grow less than the GDP improving its environmental impact.

For each indicator a macro economic model has been utilize to estimate both the trend and the impact of DEF.

To know more on BES:

To Know more about Happiness how to measure, increase and manage

Responsible Investing – The Rising Tide

Dave Rae

Serious momentum is building in the responsible investment space. According to the Responsible Investment Association Australasia (RIAA), 9 in 10 Australians expect their super/investments to be invested responsibly and ethically. This is no longer a fringe issue.

The trend is the same in the US. The Sustainable Signals survey by Morgan Stanley last year, found 75% of active investors (and 86% of millennials) describe themselves as being interested in sustainable investing.

Recently the head of Blackrock, Larry Fink wrote in his annual letter to CEO’s:

What a significant statement from the largest fund manager in the world!

In Australia, fund managers such as Perpetual, Australian Ethical, BT AMP have offered sustainable or ethical specific investment options for some time. But in recent years there have been some new entrants. These managers are questioning the idea that investing is just about making money:

Eight Investment Partners (Impact Fund)

And as recently reported in the AFR, former head of Perpetual Ethical SRI fund Nathan Parkin is setting up Ethical Partners Funds Management and aiming to raise $3billion.

I expect we’ll see an explosion in new funds in the sustainable/ethical/impact space over coming years. But investors will need to take a close look under the bonnet.

Firstly to make sure a fund is aligned with their values. This can take a fair amount of work. It can also be a case of the more you learn the harder it gets. But research and guidance from experienced investors are invaluable.

And secondly to make the investment is true to label and not (deceptively trying to sound responsible/ethical).

And you know what, it feels bloody good to know you are investing in companies, ideas technologies that are making the world a better place now and for our future.

What do you think? Do you invest in responsible options? Are you considering it?

You can read more of my articles here.

This information has been prepared without taking account of your objectives, financial situation or needs. Because of you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation needs. This website provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.

Reporting for IMPACT

Sustainability Accounting Standards Board (SASB)

Founder and Former CEO, SASB

Chair of the SASB Standards Board

Sector Chair for Infrastructure

The SASB is an independent standards board that is accountable for the due process, outcomes, and ratification of the SASB standards, including any changes to the standards going forward. Members of the SASB are appointed by the SASB Foundation Board of Directors. The SASB operates in a sector committee structure, which assigns a minimum of 3 board members to each sector for reviews, discussion, and liaising with staff.

The High Level Group on Sustainable Finance submits its report to the European Commission 1/31/18

Article by Zaouati

Full report here

The High Level Expert Group (HLEG) on Sustainable Finance set up by the European Commission, of which I had the honor to be a member, publishes its final recommendations today. After a year of work, we are collectively proud of the result, which will enable the Commission to launch an ambitious action plan to put finance in Europe – and beyond – at the service of sustainable development. The Paris marketplace should be at the forefront of this ambition.

The release of this report is highly significant, because it is certainly the most comprehensive and ambitious action plan in the world that has been published on sustainable finance so far.

The recommendations that have just been delivered to the Commission revolve around several axes, with eight transversal recommendations identified as the most urgent and operational, and twenty other recommendations intended to consolidate our ambition in the long term. All of them are important, since we put forward a global approach of transformation of the financial system in the service of a more sustainable and inclusive society. I would like to detail, however, three of these recommendations, which illustrate the spirit of our report and which, in my view, can help to change the situation rapidly.

A keystone: the European taxonomy of sustainable assets

The first recommendation, the keystone of many other proposals, is the development of a taxonomy of sustainable assets at the European level. Its objective is to answer the recurring question “in which sectors should we invest to finance the transition? “, and to respond to the risk of greenwashing by defining the notion of an asset favoring sustainable development. We expect the European Commission to first define the sustainable assets in the area of climate mitigation. In a second step, this taxonomy should be extended to other environmental and social aspects. It is essential for Europe to agree on this classification. China, for example, has already enacted its own taxonomy.

This taxonomy will contribute to the creation of standards and labels for sustainable finance products. This will be the case for green bonds, but also for investment funds intended for the general public. The report clearly recommends it. This could pave the way to imagine at a later stage standards for bank loans, or the definition of the “green” part of the activity of a listed company, and therefore green market indices that comply with this taxonomy.

Involving citizens and end investors

This evolution is even more important since the labeling systems are of great interest to citizens who are also savers. A green label will help them target investment products in favor of the energy and ecological transition. There is a real expectation from citizens and civil society, which is regularly demonstrated by opinion studies. The creation of demanding labels is a way of not disappointing them.

The recommendation of the report that is the most important to me is therefore the one concerning savers, the “retail package”, which proposes a set of measures intended for the mobilization of citizens. First, we propose that retail investors to be systematically consulted by their investment advisor about their sustainability preference, and not only about their risk preferences, as currently required by the MiFID Directive. Second, it will be necessary to provide more complete and accurate information to enable savers to better choose their investments. The so-called “responsible” products (ISR, ESG, green, etc.) are very numerous today on the market, but when citizens have access to them, they cannot always check neither the ingredients nor the recipe. We recommend that only products meeting minimum quality criteria to be qualified as responsible. The French Financial Market Authority (AMF) has favored such development in its latest report on SRI. Finally, we support the creation of an eco-label for financial products intended to the general public, as has been done in France with the TEEC label (Energy Transition and Ecological).

Enhanced transparency

A third key aspect of the report is stakeholder accountability and transparency. The HLEG recommends integrating the consideration of environmental and social issues into the fiduciary obligations of investors. In other words, to make investors responsible for their impacts.

On the issue of transparency, we have relied on existing work and regulations. First, the recommendations of the TCFD (Task Force on Climate Disclosure), which published its final report in July. The TCFD recommends the publication of a climate reporting and sets an extremely precise framework on the reference documents that companies should provide (governance, strategy, risk management and indicators used). Nonetheless, this communication remains voluntary. Conversely, in France, the article 173 of the Ecological and Energetic Transition law requires institutional investors to communicate how they integrate climate-related risks. Lastly, the Non-Financial Reporting Directive (NFR) applicable since January 1, 2017, applies to public and private companies in the 28 EU Member States. A review of this directive is scheduled for the end of 2018: this is an opportunity to give the EU a more appropriate transparency regime. Our recommendation is to build upon these existing blocks in order to attain a level of transparency that is commensurate with the information needs of the financial system regarding the transition. We therefore suggest, on the one hand, extending to the European level the experience of Article 173 for financial institutions, and on the other hand, encouraging the voluntary implementation of TCFD recommendations by non-financial companies, before making them mandatory by 2020. We want to be both pragmatic and ambitious.

A green supporting factor ?

The report did not put an end to all the debates. The “green supporting factor”, initially proposed by the French Banking Federation (FBF) and taken over by the European Parliament, consists in reducing the capital requirement of banks for the financing of the energy transition. This idea is explicitly mentioned in the report, but we have not reached a consensus. Some members consider that prudential regulation should remain exclusively dependent on the risks taken by banks and that there is no evidence at this stage that green assets are less risky than others. Others consider that the risk induced by non-durable assets should be penalized as a priority before removing the constraint of banks. Others finally consider that both options should be examined.

I personally supported the introduction of a Green Supporting Factor that would send a strong message to the banks, which are the main financiers of the European economy. In my opinion, it seems difficult to state that climate change induces systemic risks for the financial markets while omitting to take them into account in banking regulation. European Commissioner Valdis Dombroski has declared himself in favor of applying such a mechanism. It is now up to European political leaders to decide.

Towards an ambitious action plan at the European… and French level

The Commission has already announced that it will present an action plan for sustainable finance in March 2018. This goes far beyond what we expected when the work of the HLEG started, and here we must salute the courage of the Commission to take stock and action very rapidly, despite a particularly constrained calendar and political and institutional context. We hope that the Commission will not only repeat a few emblematic measures, but rather that our work will lead to a deep change in the vision of the role of finance.

This underlying trend must obviously be relayed at the level of Member States. In France, the Ducret-Lemmet report, published in December, which fueled the first announcements of the Minister of the Economy during the Climate Finance Day, is a chance. It poses the foundations of a renewed financial system. The Paris marketplace has a real know-how and a very rich ecosystem in green finance. Several of the HLEG report’s recommendations are based on French examples. We must remain at the forefront and continue what has been started in recent years. Building a niche will not be enough: green and sustainable finance

IMPACT investing

IRIS is managed by the Global Impact Investing Network (GIIN), a nonprofit organization dedicated to increasing the scale and effectiveness of impact investing. The GIIN offers IRIS as a free public good to support transparency, credibility, and accountability in impact measurement practices across the impact investing industry.