Finance, Sustainability and Happiness

I am most touched by the kind invite to share with you my thoughts and reflections on how Finance, Sustainability and Happiness can work for the Good of Society. I thank Verslo Zinios for organizing the event, SvedBank for the support, Ieva and Agne who found my articles and experience worth sharing in this important conference.

One of the most recent articles was written after a Global Finance Forum in Novartis, one of the world largest pharmaceutical companies, where I have been working in the last 28 years, covering positions in Finance, Operations and Business, in Italy, Globally and in Europe. Currently I am the Country CFO of the Italian 1.7 B $ operation with 2,600 employees.

During the Forum, together with other passionate colleagues, we spoke about ‘Co-creating Social Impact’, debating about the way Finance can be Sustainable and Social. It was impressive to see how many Finance associates were already engaged into considering Sustainability part of the decision making process. The wealth of best practices, experiences, material and exchanges was huge.

Every time I share my thoughts, I find Finance and non-Finance people agreeing that the matter requires attention and action. I presented and shared my philosophy at conferences in Milan, Paris, Basel and Oxford; via a blog and with about 30 articles on LinkedIn.Then I am thrilled to start as a Key note speaker in this prestigious Lithuanian Financial community. Unfortunately I cannot speak your language but coming here encouraged me to learn more about Lithuania, and helped me to discover an exciting story of Happiness that I will share in a few minutes.In the next 20 min, I will reflect on the role of Finance today in economy. When I use the word CFO I do not refer only to that group but I include all the leaders in Finance, Tax and Accounting that can work as well for the Good of Society, leveraging Sustainability and Happiness.

It is undisputed today that the CFO is a relevant leader, in each mid to big size corporation. According to EY today the CFO provides not only financial planning and analysis, but information about where the business is going and how quickly it is getting there. CFOs are deeply involved in supporting and enabling strategy and most work side-by-side with the CEO. Involvement in corporate strategy has become an integral part of the job. CFOs now have the ability and the mandate to contribute directly to the direction of the business as well as reviewing and reporting on its performance. According to the Economist, the CFO is, towards the analysts, more credible than the CEO and they define him, the Supremo.In this room, I am sure we all agree, but then if the CFO is so influencial where we should drive our company towards?

Can a CFO be Happy?

My personal engagement on the Sustainability Agenda, is relatively new.

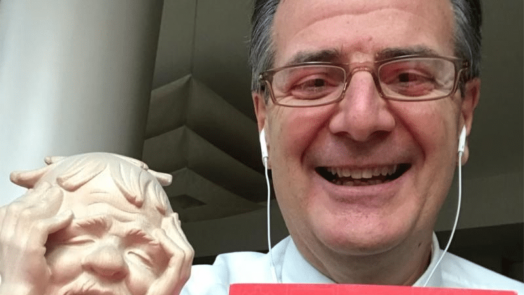

At the end of 2016, my unit overachieved Budget: we grew double digit, we increased profitability, market share was up, too. During the pre-Christmas party, someone took this picture and I used it to thank the many that contributed to such a success. I called it ‘The Happy CFO’. All targets were over achieved, my unit was in great shape: shouldn’t be the time to share positive feelings, emotions and happiness? I was so happy and content of the achievement and enjoying absorbing the happiness of the many colleagues in the same situation. I sent many Xmas cards using it and many colleagues were surprised: “Many other adjectives would match with CFO but ‘Happy’ shouldn’t”, they said.

My colleagues were surprised to know that I was Happy as usually I was monitoring their businesses with the cold eyes of analytics, I was keeping good note of their past performance both in terms of successes and failures, with not a lot of emotional involvement, as I had to optimize the resource allocation. I realized that more than Happy, I was appearing at their eyes as unsatisfied. Too many were the requests, too few the resources available.

“Happy” and “CFO” seemed an oxymoron. Unbelieving, I surfed the Web: they were true. Google did not find neither correlation nor constant match. Very few lines of the search engine had the two words together.

Then I took a pillar book on Finance by Robert J. Shiller, Yale University world known Professor – “Finance and the Good Society”. I searched if happiness and emotions could be part of the roles. With despair, I read: “An accountant has to keep emotional distance from the people and organizations he or she serves, so as not to be drawn into any of their machinations. Of particular importance, a corporate accountant must feel a general sense of sympathy for the various claimants to the organization’s purse, so as to remember all of them and trait them fairly.” So it was true, also for the Nobel Prize Shiller, the CFO is someone that has to keep emotional distance. Being Happy cannot be a status of the CFO and the Accounting team!

What is Happiness and why it drives the World

I decided to bring a different perspective to the Finance profession, as I think that the World needs Happy CFOs, capable to reach the short term objectives of his or her unit without compromising the long term sustainability. Able to optimize the use of money but taking care of environment and social situation. Capable of applying emotional intelligence while allocating resources, taking into consideration the behavioral economics so well described by Kahneman and use it with compassion and understanding of human beings to be fully effective as business partner. Nowadays decisions are so complex that only being open to listen to cross functional expertise and business knowledge would allow Finance to advice on the best option. Models and brain power must be adjusted by empathy, understanding a bit also the humane side of the budget owners.

When the objectives are built on listening, understanding, compassion and consensus, the sense of purpose of the whole unit is greater. Financials and company purpose blend more intimately. For my unit, for example, providing solutions to patients. Then embedded in a broader scope, when numbers turn in the right direction, Finance accomplish its role. The whole Society benefits for proper use of money. Happiness comes.

Dr. Travis Bradberry, an expert in Emotional intelligence says: “Everybody wants to be happy and live a satisfactory and fulfilling life. Already Aristotele, the Greek philosopher made it clear that “Eudaimonia [happiness] is the meaning and the purpose of life, the whole aim and end of human existence “.

“While the good news, continues Travis, is that just 50% of happiness is influenced by genetics the rest is up to us. When it comes to making yourself happy, you need to learn what works for you. Once you discover this, everything else tends to fall into place, and making yourself happy.

Should Finance associates being excluded from this journey? I do not think so. Dr. Bradberry gives some advices and suggestions about how to behave and think to live a happier life:

- Remember That You Are In Charge of Your Own Happiness so follow a scheme and take action.

- Don’t Obsess over Things You Can’t Control, what should happen it would happen if it outside of your control, do be worried and focus on what you can change. Yourself.

- Don’t Compare Yourself to Other People, the famous people tend to share only the better part of themselves, envying their status would be wrong as you compare with something unachievable. Maybe nobody in this room is likely to become the next Global CFO of Apple managing billions of assets but we still can influence a lot if we focus on our responsibilities.

- Cultivate an Attitude of Gratitude and Believe the Best Is Yet to Come.

- Exercise During the Work Week, Give Someone A Hand

- Smile and Laugh More, Stay Away From Negative People and Laugh at Yourself

Should not be this a behavioral profile of a Happy successful Finance associate?

Jacob Morgan in the 2017 book “The employee experience advantage” has demonstrated that experiential companies that are investing in cultural, technological and improved physical working environment, generated double the growth when compared with the S&P500 and even better when compared with the Best place to work rated companies. Very recently, Krekal and others of the Oxford Said Business School in the article “Employee Wellbeing, Productivity, and Firm Performance” demonstrated the correlation between performance and employee satisfaction. They conclude: “We find a significant, strong positive correlation between employees’ satisfaction with their company and employee productivity and customer loyalty, and a strong negative correlation with staff turnover. Ultimately, higher wellbeing at work is positively correlated with more business-unit level profitability”.

CFO has then to learn how to facilitate Happiness of the organization to improve profitability. Then as leaders of a group, we should share Jefferson Pursuit of Happiness. A group of Enlightened Politicians understood that citizen well being and Happiness is the highest scope of government. “The care of human life and happiness … is the only legitimate object of good government”. So as the US included this aim in their constitution we should as well include in our company missions.

The story of Happiness in Lithuania can help me make the topic less theoretical. Some of you might be familiar with The Happiness report. It annually measures the level of Happiness for more than 130 countries and consider the well-being of nations. Happiness is measured with six key variables: GDP per capita, Healthy life expectancy, Social support, Freedom of choice, Generosity, Perceptions of corruption. According to these indicators, Lithuania was number 70 in the ranking in 2012. In 2018 Lithuania has recovered almost 30 positions.

How this has happened? I do not know if there was a deliberate decision by the government and the majority of companies, but if I look at the data, Lithuania’s trend of the various indicators compared with the one of Finland, resulted as the Happiest country in 2018, improvement is everywhere. Economy was growing faster than Finland, diversity of work force accelerated decisively, health care became more accessible with an important 2 years improvement in life expectancy. Everyone feels more supported when the health system works. Finally alternative energy grew at the same pace of Finland. You, the CFOs, as leaders have contributed for sure in helping growing your country GDP, facilitating the participation of women and taking more environmental wise decisions when investing in infrastructures. You generated greater Happiness.I did not study all the other variables and I am not enough expert of Lithuania socio economical situation to draw specific conclusions, but I hope this quick comparison and example might give you the desire to consider how you may apply the logic to your own unit. If you as leader, after the today conference would keep growing your business, pay attention to the diversity of your teams, improve your working environment and the impact on external environment of your company, combined with an improved investment in company welfare, then are likely to create a virtuous circle and favor your profitability and happiness.

Sustainability

We as Finance leaders are not alone in this journey. The good news, we are not alone in sustaining the need for a better world!

The United Nations in 2015 launched the recipe for a better world, through the Sustainable developments goals (SDG), and about 190 states and many large corporations have subscribed them taking a commitment in terms of improvements of the way we do business, improving wealth distribution, health, reducing poverty. These SDGs provide a vision for the future: a vision around which action can be mobilized, where we put nature and society back at the heart of our considerations. The SDGs call for leadership and practical action from both the public and private sectors and there is an extremely compelling business case for organizations to deliver the goals. It has been estimated that achieving the SDGs will open up 12 trillion u.s. dollars of market opportunities by 2030.

Then opening the company to take into considerations the social impact gives the CFO a very different perspective.

Already in 1994, John Elkington coined the term Triple Bottom Line to propose a way to build the P&L considering the scope of a company broader than the pure profit creation and he was right, as now the expectation from society is that a company doesn’t not only generate profit. The TBL accounting framework includes three parts: social, environmental (or ecological) and financial. It has been quite widely adopted. It allows businesses to evaluate their performance in a broader perspective and to create greater business value.

In 2004 HRH Prince Wales founded Accounting for Sustainability Project whose aim is “Inspiring action by finance leaders to drive a fundamental shift towards resilient business models and a sustainable economy. He recently addressed the Finance community, at May CFA Institute in 2019 saying: “Policy, technology and data will all need to play their part in addressing these challenges, but finance and investment, in particular, are an absolutely crucial part of the solution. In the simplest of terms, capital needs urgently to be allocated away from activities that generate negative externalities and towards those that will make a positive impact on one or more of the Sustainable Development Goals.”

In Novartis to say it with our CEO Vas Narasimhan: “the only reason we can deliver profits to the world, to our company and to our shareholders is when we positively impact society.”

Vas is encouraging Finance to discuss on Purpose and for Novartis in particular, SDG number 3 – Good Health and Well-Being – represents an opportunity to provide solutions to the World. We address Malaria and other communicable disease and reduce premature mortality to more widely spread ones (as for example diabetes and cardiovascular ones) with special programs at minimum margin, while considering the value for society. Developing new and innovative ways to reach people in lower-income countries is one of Novartis top priorities. To expand access to healthcare, it pursue a variety of approaches“.

ESG investments have reached 30 trillions more than doubling in 6 years. HRH reminds us: “The good news is that, not only are investment professionals becoming aware of the positive impact on performance that can be achieved by incorporating E.S.G. considerations into investment processes, but many are also increasingly conscious that demand for these products is rising fast, both by institutional and retail investors, and that society, in the shape of regulators and policymakers, is, at last, starting to require action.

According to Professor Alex Edmans of the London Business School, Finance and Sustainability go together. He says:”The idea that companies and investors can both do good and do well is finding ever greater traction among executives, shareholders and wider society. It is easy to see why. If the business case for environmental, social and governance (ESG) integration holds true, capitalism can rebuild trust by addressing some of the world’s biggest challenges, such as the climate crisis, while generating long-term returns for ordinary citizens and helping to reduce inequality.

Companies that genuinely adopted ESG policies beat their peers who did not by 4.8 per cent a year over 18 years.

For companies, ESG integration can provide a competitive edge. For investors, it can help them to beat the market through a discerning investment strategy.

The challenge ahead is for companies and markets to work together in the relatively unfamiliar territory of ESG to enable society to develop sustainably.

Finally the EU has proposed a way to report ESG (Environmental, Social, Governance rules) to big companies with the 95 directive of 2014, implemented in Lithuania as well, as reported by the Member State Implementation Report 2017. Having non financial data would support the growth of ESG investments.

Then I would like to conclude my presentation with 3 proposal to this powerful and qualified audience:

Create Awareness in the Finance Community and in Society

At this point, it appears very clear that proposing to our CEOs to include Sustainability and Happiness in the company strategy is a must. Engaging stakeholders, Customers, investors, employees to define jointly the company objectives appears the way to go for a socially wise company. The CFO can act as change agent sustaining a long term vision to contrast short termism typical of current times. As companies greatly contribute to economy of a country, doing so, the CFO contributes to the country Happiness and well-being and becomes Happy. It is time to own promotion of Happiness, in the deep meaning that Thomas Jefferson proposes.

SDG 17 Strenghten domestic resource mobilisation while Enhancing policies coherence for sustainable development is the vision and compass we should follow as CFOs. Encourage and promote effective public, public-private and civil society partnerships, building on the experience and resourcing strategies of partnerships is the suggested way for an ESG based strategy.

Voluntary adoption of EU directive

Globally, the company I work for was among corporations that pioneered the adherence to the Global Compact and more recently it is taking the SDGs as reference for our environmental and social policies. However, at a country level, where I operate, some of these policies may appear a bit distant or only represented by a number of KPIs to be reached. As part of my creating awareness program, in Italy, I realized the first draft of Integrated reporting for the activities in the country. In this way not only the Financial impact we are having on GDP but also the contribution to society and environmental impact will be represented. It was very successfully presented in a public conference. Many corporations have developed their global IR but in my case, I think it will be one of the first with a measure of the footprint in a specific country. If we want to make Society aware about corporation impact, it is much better to do it locally, where people can more easily see the impact.

Plan your new ESG strategy

There is an imperative for the CFO to be the steward of the long term. Bertrand Badrè the author of “Can Finance save the world?” made it clear in a recent speech in Italy: “It’s boring and our leaders won’t like it, but we must work on the “short-term bias” in the financial system, through accounting principles, compensation, and so on. Impact investing, ESG, social-impact bonds are still linked to the good will of few: they have to be incentivized. Otherwise, we should be aware that the machine to produce crises is still there”

Two years ago, I started taking action, under the logo “The Happy CFO”, reflecting and sharing information, ideas about how Finance, Sustainability and Happiness can be connected. My recipe is simple and at the same time, very challenging: «Our companies will continue to be profitable and generate work for our great-grandchildren, if the CFOs convince their CEOs that short term orientation, not balanced with objectives of environmental and social sustainability, will not last long.».. Join me, become a Happy CFO.